CALIFORNIA GAS PRICES

What Is The US National Gas Price?

up from 3.636 last week and up from 3.606 one year ago.

This is a change of 2.09% from last week and 2.94% from one year ago.

Why Are California Gas Prices So High?

State’s High Gas Prices have Potential to Rise even Higher

April 14, 2024 By David Lightman

A gallon of regular gasoline in California Wednesday averaged 53 cents higher than a month ago. Will it go much higher?

It’s tough to predict, but the potential is there because a big driver of the price spike is international tension. The Russia-Ukraine war and Iran’s threats to Israel are adding a new dose of uncertainty to an already volatile mix of reasons prices go up as summer approaches.

“Ukraine attacked Russia’s supplies, and Iran has become a major threat in the last two weeks,” said Sanjay Varshney, professor of finance at California State University, Sacramento. An Israeli attack on the Iranian consulate in Syria April 1 killed several Iranian military officials. U.S. officials are expecting Iran to retaliate. The tension in the Middle East is among the reasons U.S. oil prices are up about 20% this year, ranging recently from roughly $85 to $90 a barrel. A gallon of regular gasoline in California Wednesday averaged $5.41, according to AAA. That figure was the highest in the country, topping runner up Hawaii by 69 cents a gallon. The national average Wednesday was $3.63.

California’s average was 53 cents a gallon more than a month ago and 21 cents above the cost a week ago.

Local prices included:

Sacramento, the average was $5.53, up from $4.86 a month ago.

Fresno, $5.41 Wednesday, $4.77 a month ago.

Modesto, $5.41 Wednesday, $4.70 a month ago.

Merced, $5.44 Wednesday, $4.82 a month ago.

San Luis Obispo area, $5.55 Wednesday, $5.06 a month ago.

Prices “should normally go down but we see geopolitical risks going up at times with potential involvement of other countries in the Middle East and Ukraine regional conflicts. This gets reflected in terms of higher prices at the gas pump,” said Gokce Soydemir, Foster Farms endowed professor of business economics at California State University, Stanislaus.

While the average California price is still well below the June 2022 record of $6.44, and shows no immediate signs of getting anywhere near that, several elements are still in play that could keep prices at current levels, if not higher.

Doug Shupe, Automobile Club of Southern California spokesman, cited “planned and unplanned refinery maintenance has caused supply issues” affecting prices. Imported gasoline has been ordered and should arrive later in April, according to the Oil Price Information Service, which specializes in price and supply trend data.

Shupe noted there is also planned maintenance at a refinery in Washington state that supplies Southern California and could last several weeks. Any refinery interruption has an important effect on supply.

California requires that drivers use a special blend of gasoline aimed at reducing emissions from motor vehicles. That means the state’s refineries produce cleaner fuel. “Refineries in the state often operate at or near maximum capacity because of the high demand for those petroleum products and the lack of interstate pipelines that can deliver those cleaner fuels into the state,” said an analysis from the federal Energy Information Administration. When a refinery has to shut down, the lack of supply from interstate pipelines “means replacement supplies of (California gasoline) come in by marine tanker from out-of-state U.S. refineries or from other countries. It can take several weeks to find and bring replacement motor gasoline from overseas that meets California’s unique specifications.”

Legislation

Proposition 111 was approved by voters in 1990 and increased the tax rate on motor vehicle fuels from 9 cents to 14 cents per gallon. The initiative further increased the excise tax rate by 1 cent per gallon per year until the rate reached 18 cents per gallon on January 1, 1994, where it remained until the Legislature enacted the fuel tax swap.

In 2010, the budget bill ABx6 8 was signed into law and reduced the state sales tax on gasoline and replaced it with an increase in the fuel excise tax. This “tax swap” reduced the gasoline state sales tax to 2.25%, but added an excise tax of 17.3 cents per gallon. The budget bill’s goal was to raise the same amount of money as the previous system, but the new excise tax was slowly increased and adjusted each July to retain revenue neutrality.

Furthermore, the bill shifted past and future transportation-related debt service repayments on general obligation bonds from the General Fund to the fuel excise tax fund.

The gas tax/sales tax swap was supposed to be revenue-neutral at the time, and indefinitely into the future. Thus, the bill mandated that the Board of Equalization (BOE) annually adjust the excise tax rates for gas and diesel so the revenues obtained from the swap would reflect what the growth rate would have been in the absence of the swap. A recent Senate Governance and Finance Committee analysis aptly stated:

“[the] BOE then calculated an adjustment to the excise tax, which is measured as a flat amount per gallon, to reflect sales and use taxes, which apply based on a percentage of [what] the sales prices would have been but for the swap.

“As a result, the motor vehicle fuel tax rate increased $0.17 to $0.35 on July 1, 2010 to compensate for the removal of the state share of the sales and use tax rate that was measured at 6% of the sales price. The diesel fuel tax rate went down from $0.18 to $0.136, but the sales tax rate increased by 1.75% of the sales price. When voters approved Propositions 22 and 26 in November 2010, the Legislature reenacted the swap in 2011, with some modifications.”

Current State of Affairs

SB 1 was authored by Senator Jim Beall (D-San Jose) in 2017 in an effort to address the erosion of purchasing power of the fuel excise taxes and resulting numerous delayed maintenance projects on California’s roads. SB 1, supported by the California Chamber of Commerce, augmented the state’s motor vehicle fuel taxes while directing the revenue to road maintenance and construction. The bill increased the excise tax on gasoline by 12 cents per gallon and diesel fuel by 20 cents per gallon and increased the sales and use tax on diesel by 4%. Additionally, SB 1 required an annual adjustment of the motor vehicle and diesel excise tax rates based on the California Consumer Price Index.

In 2018, Proposition 6 was placed on the ballot and opposed by the CalChamber. Although the initiative ultimately failed, it aimed to repeal all the transportation taxes adopted by the Legislature in 2017, including higher gasoline and diesel excise taxes, a new tax on vehicles, and a new tax on zero-emission vehicles. The measure also proposed requiring any future legislatively imposed taxes on fuels and vehicles to take effect only upon a statewide vote of the people.

Repealing the gas tax would have stopped transportation improvement projects already underway in every community in California, eliminated funds already flowing to every city and county to fix potholes, make safety improvements, ease traffic congestion, upgrade bridges, and improve public transportation. The Legislative Analyst’s Office estimated that the measure would have reduced spending on state and local transportation projects by nearly $5 billion annually.

By 2021–2022, the fuel tax rate had increased to 51 cents per gallon based on inflationary adjustments. In July 2022, the gas tax rate increased 5.6%. That takes the current tax up to 54 cents per gallon. The state tax is separate from the federal excise tax of 18.4 cents per gallon, 23 cents for California’s cap-and-trade program, 18 cents for the state’s low-carbon fuel programs, 2 cents for underground gas storage fees, plus state and local sales taxes, which average 3.7%.

Congressman Doug LaMalfa (R-Richvale) and the entire California Republican congressional delegation sent a letter to Governor Gavin Newsom opposing the impending gas tax increase of 8% on July 1, 2023. The lawmakers also called on the governor to extend the partial diesel sales tax exemption, which is set to expire this September. Congressman LaMalfa also joined a similar effort to suspend the gas tax last year, when Californians were paying around $6.00 per gallon. An increase of 3 cents per gallon went into effect July 1, 2023.

The state’s gas tax goes up every July to adjust for inflation and help pay for the roads, and the latest increase puts it to around 58 cents per gallon.

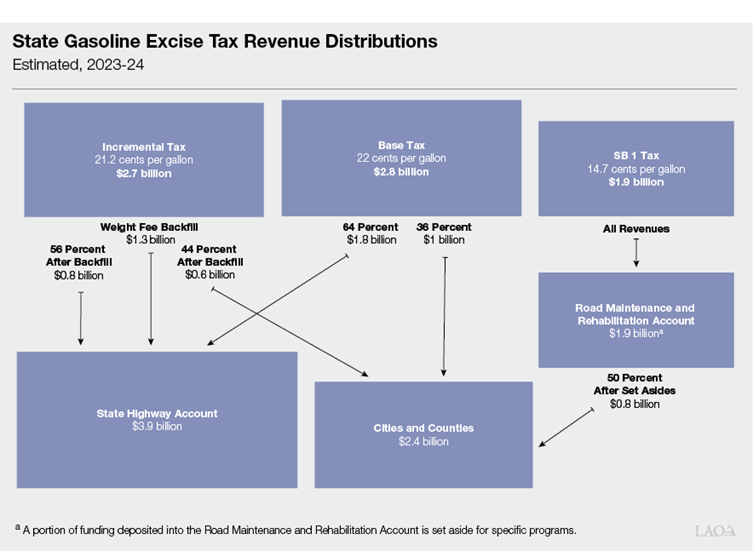

State Excise Tax Pays for Highways and Roads

In 2023-24, the state gasoline excise tax is set at 57.9 cents per gallon, and the tax is expected to raise $7.4 billion from gasoline purchases for vehicles using public roads. In effect, the 57.9 cent tax is comprised of three distinct components, each of which is adjusted for inflation in July and allocated based on formulas set forth in state law. The figure below shows a simplified version of how of each of these taxes are allocated to major transportation accounts and programs.

CA Potholes Are Among Country's Worst, New Analysis Shows

Two California Cities Were In The Top Five For Worst Potholes, And The Series Of Storms Pounding The State Hasn't Helped The Problem.

Anna Schier, Patch Staff Posted Wed, Feb 28, 2024 at 2:09 pm PT|Updated Thu, Feb 29, 2024 at 9:19 am

Potholes are a problem in California, a new analysis found. (Shutterstock)

CALIFORNIA — Dodging potholes could become a sport in California, which ranks sixth in the country for axle-jarring craters, according to a new analysis of Google searches for pothole-related terms from USA Today.

Los Angeles ranks second nationally for potholes, according to the analysis. San Francisco is fifth, Sacramento is 13th and Fresno is 43rd.

Potholes are formed when the top layer of pavement and the sub-base beneath can no longer support the weight of traffic. Small cracks expand over time, allowing water to seep in. Hitting a pothole can result in expensive repairs that insurance won’t always cover.

USA Today based its analysis on Google Trends data from 2020 to 2023 for terms such as “pothole,” “potholes,” “pothole repair,” “pothole damage” and “pothole complaint.” Each term was given a search index number, which was then used to generate composite scores for cities and states.

In 2022, about 44 million drivers paid an average of $460 each last year to have their vehicles repaired after hitting potholes, according to recent AAA data. The number of pothole-related repairs to vehicles shot up about 57 percent between 2021 and 2022, the data shows.

Check with your local authorities to see if your pothole damage is eligible for reimbursement.